Simplified Approvals

for Smart Businesses

Credit and spend management solution

for your modern business.

Trusted by 1,000+ businesses just like yours

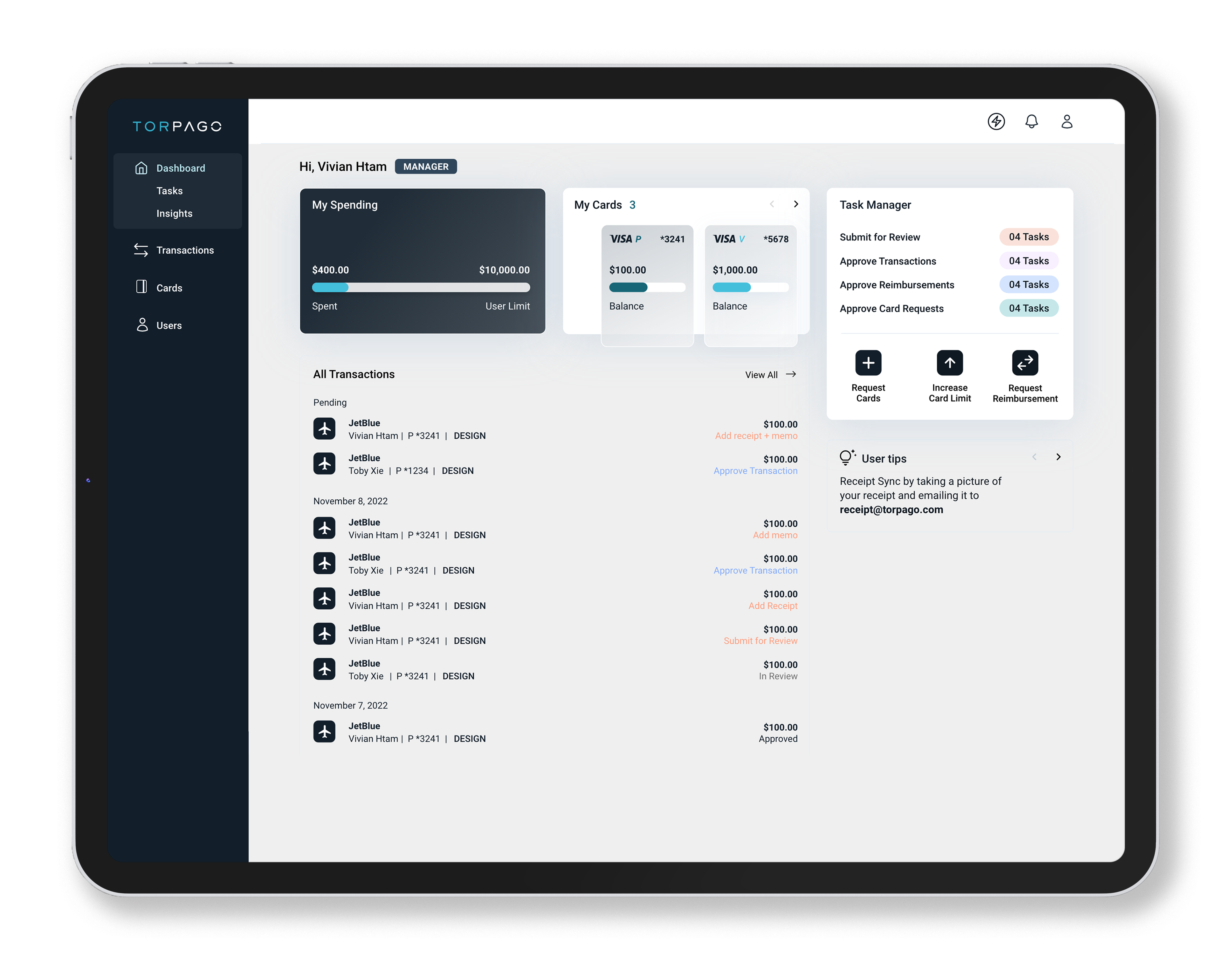

Spend management.

Done right.

Corporate Card

Issue unlimited virtual and

plastic cards.

Spending Policies

Empower your team with the appropriate

safe guards. Trust but verify.

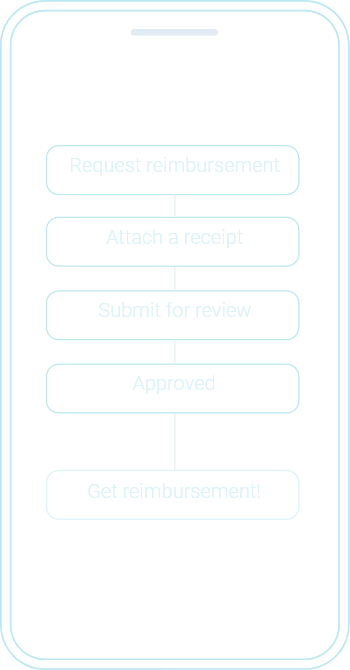

Reimbursement

Reimburse non card spend through the Torpago platform.

Accounting Bliss

Torpago connects to all the tools that you use. Let us code and sync so your team can focus on more important work.

Modernize your business.

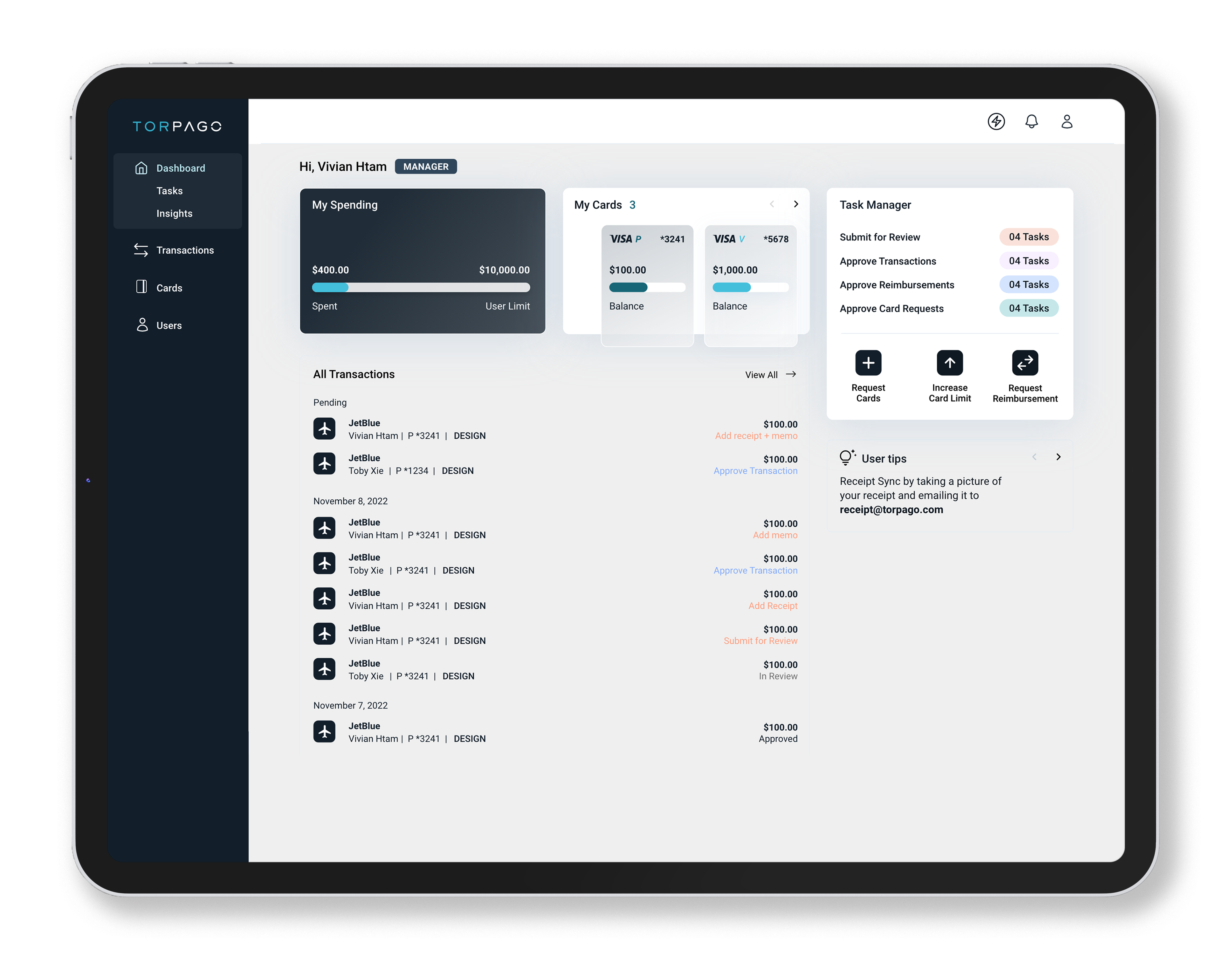

Easy Card Management

From spend, approvals, bill pay - managing all your businesses’ finances is easy when you can access it all through our platform or mobile app.

Simplified Spending

Issue and request cards in seconds. Control and track spending on cards in real-time to save money.

Smarter Business

It only takes a few minutes to sign up and set up your account. Get the credit limit you need and spend to reach your business goals.

All Your Financial Tools Simplified Into One

Ready to start spending smarter?

Network, late payment, failed payment and international transaction fees may apply.

The Torpago card is issued by Sutton Bank, Member FDIC pursuant to license's from Visa U.S.A Inc. Credit is issued and administered by Torpago, Inc.