Powered by Torpago

Agent Model

Go to market with a technology-rich business credit card program in as little as 60 days.

Add a market-leading business credit card to

your offerings without the operational headaches.

Cutting-edge technology

Easy program management and real-time data access for your team, feature-rich integrations and apps for your customers!

Flexible engagement models

Leverage a partner bank BIN to launch a branded program and control as much – or as little – as you want.

Program management services

Augment your bank's capabilities when it comes to underwriting, fraud services, or customer support.

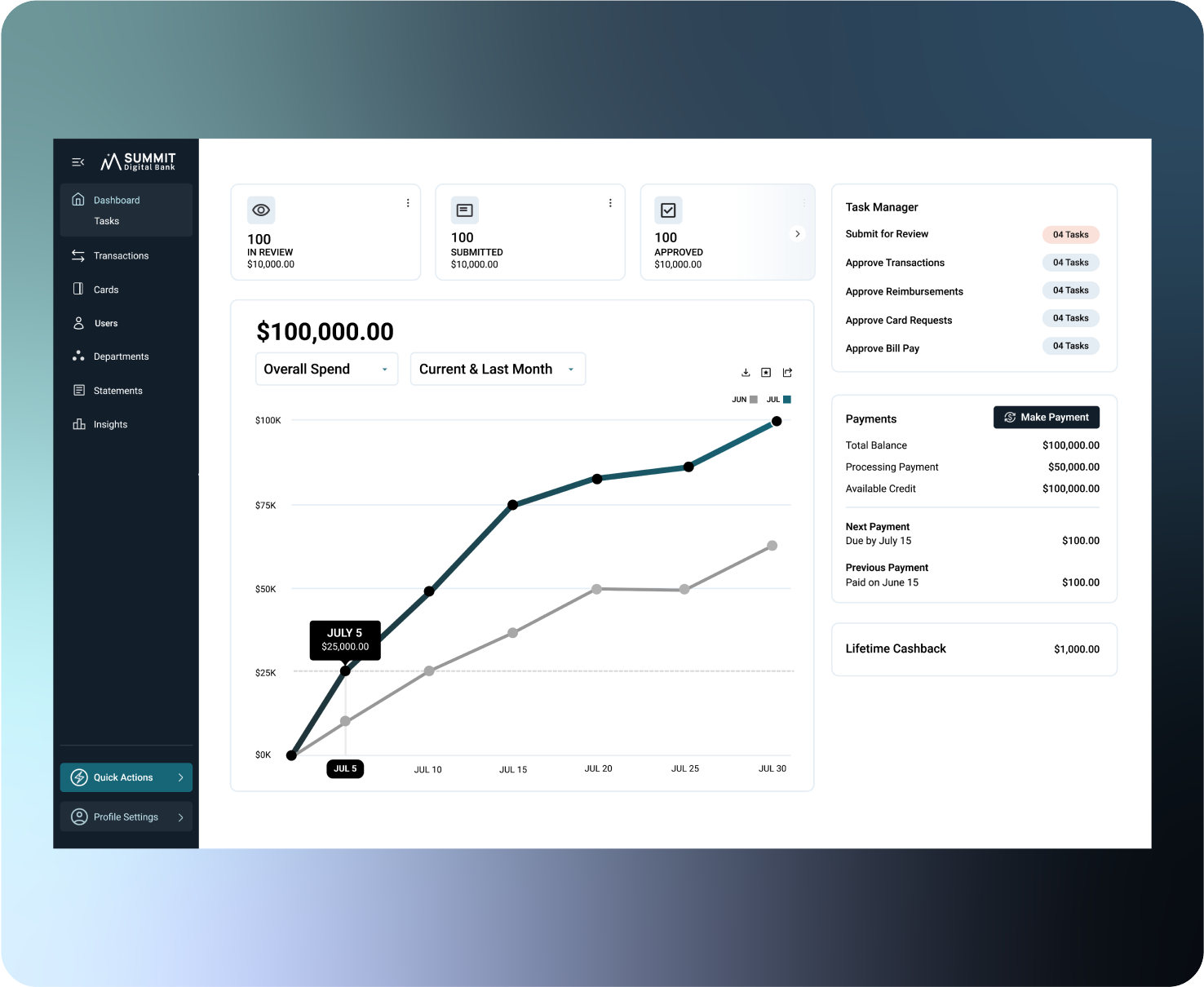

Torpago Spend Management Platform

-

Cloud native platform built for scalability and flexibility

-

Built with native ERP, payroll, and accounting integrations and Open APIs

-

Enables effective expense management with expense approval workflows and multi-level spend controls

-

Supports bill pay, reimbursements, receipt intelligence

-

Designed for both web and mobile application usage

-

Empowers account administrators to select appropriate user profiles

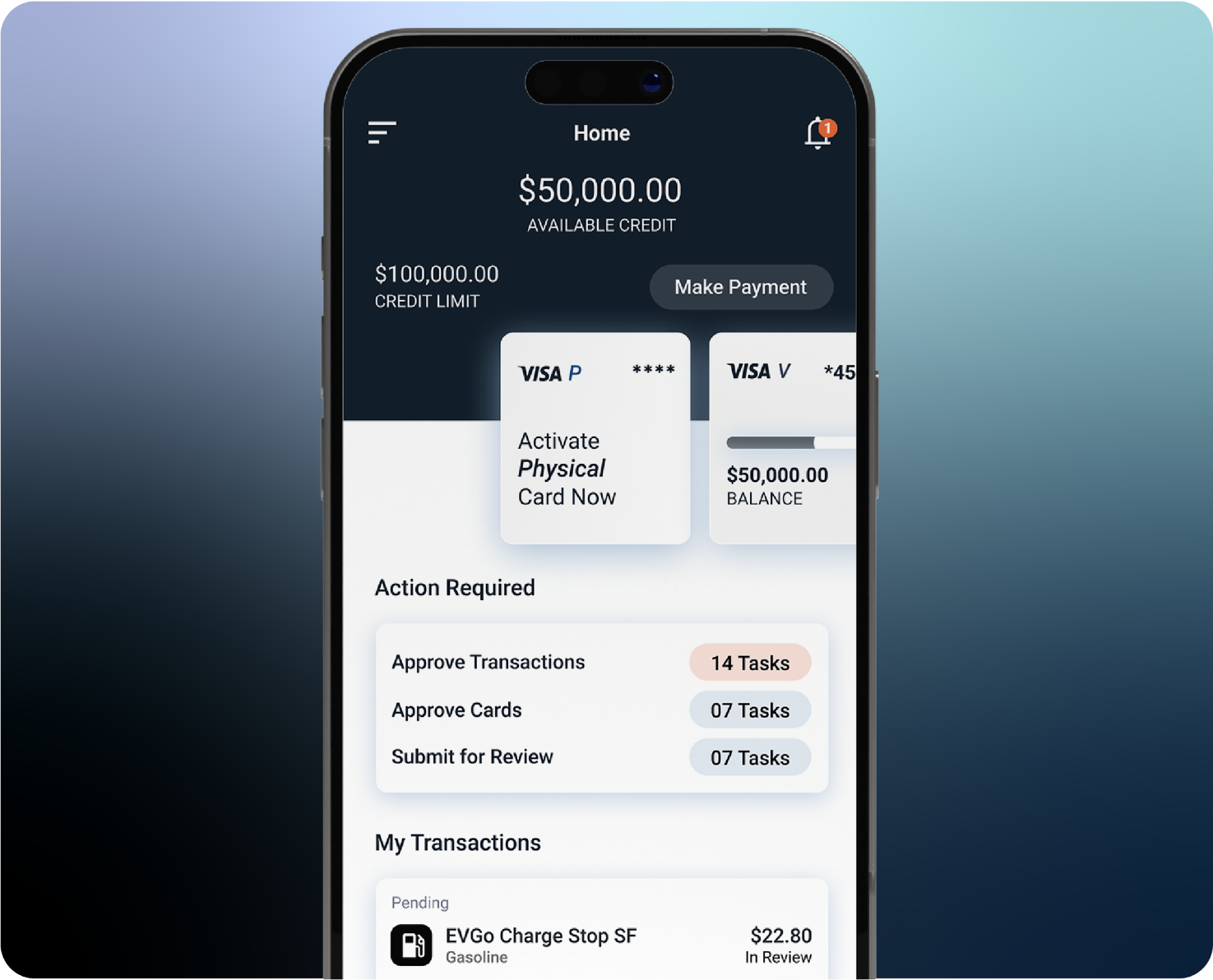

Torpago Mobile App

-

Available for both iOS and Android

-

Supports in-app digital wallet provisioning

-

Provides overview of spend power, transactions, and restrictions

-

Real-time card usage and spend alerts via push notifications and text messages

-

Enables expenses and reimbursements to be submitted in real time

Agent Standard

Optimized for minimal resource needs

-

Branded cards and customer portal

-

Torpago-provided BIN

-

Torpago-managed balance sheet exposure and underwriting criteria

-

Torpago-provided underwriting, customer support, compliance, and collection services

-

Launch in 60 days

Agent Premiere

For banks with a sales and balance sheet risk plan

-

Branded cards and customer portal

-

Torpago-provided BIN

-

Bank-managed balance sheet exposure and underwriting criteria

-

Torpago- or bank-provided servicing – choose only the support you need

-

Launch in 120 days

Underwriting

Our underwriting team uses an AI-powered approach to protect balance sheets while providing customers with the spending power they need.

Compliance

Ensure your program adheres to all relevant regulations and industry standards with proactive practices to mitigate risk and avoid potential penalties.

Customer Support

Increase customer satisfaction by offering 24/7 live support via chat, email, or phone without having to build your own call center.